|

Getting your Trinity Audio player ready...

|

Crypto market sentiment refers to the overall psychological and emotional state of market participants about a particular cryptocurrency or the entire crypto market. The aggregate of beliefs, opinions, and emotions drives the actions and decisions of investors, traders, and other market participants in the crypto space. The sentiment can be positive, negative, or neutral, and it plays a crucial role in shaping the future of the crypto market.

Favourable market sentiment doesn’t always lead to positive market conditions. Sometimes, strong positive sentiment (it’s going to the moon!) may come before a market correction or even a bearish market.

Why is it important?

Market sentiment analysis is the process of evaluating the overall emotional and psychological state of market participants to determine the prevailing sentiment in the market. This analysis involves the use of various tools and techniques, including social media and online forums analysis, sentiment analysis software, and technical analysis, to gather data and insights into the mood of the market.

How to perform market sentiment analysis

Market sentiment analysis can be conducted by tracking various sources of data and information. Some methods include:

- Tracking Social Mentions: By using data collection software tools, it is possible to track social mentions and online discussions surrounding a particular cryptocurrency. This can provide valuable insights into the opinions and emotions of market participants.

- Staying Up-to-date with Industry News: Keeping up with the latest industry news and developments can provide valuable information about the market sentiment surrounding a particular cryptocurrency.

- Tracking Large Transactions by Whales: Monitoring large transactions made by whales can provide insights into their market sentiment and actions.

- Checking Market Sentiment Indicators on CoinMarketCap: Various indexes analyze a range of different sources and provide easy summaries of current market sentiment.

- Measuring the Level of Hype with Google Trends: Google Trends can provide valuable insights into the overall interest and excitement surrounding a particular asset, which can impact the market sentiment. An increase in search interest can indicate increased market sentiment and hype.

Market sentiment indicators

A market sentiment indicator is a tool used to measure the overall emotional and psychological state of market participants. It provides insights into the prevailing sentiment in the market, which can have a significant impact on the price and performance of assets.

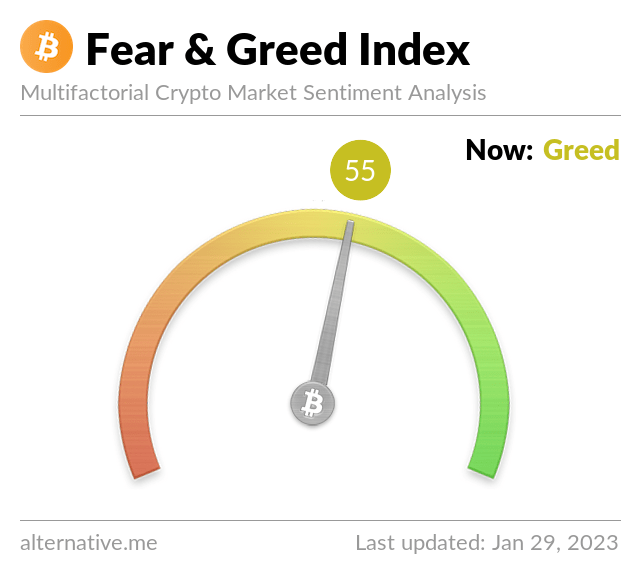

Most market sentiment indicators are focused on Bitcoin (BTC), but you can also find Ethereum (ETH) sentiment indexes. The Bitcoin Crypto Fear & Greed Index is perhaps the most known indicator of crypto market sentiment. The index ranges from 0 to 100, with a score of 0 indicating extreme fear, a score of 100 indicating extreme greed, and a score in between indicating varying degrees of fear or greed.