|

Getting your Trinity Audio player ready...

|

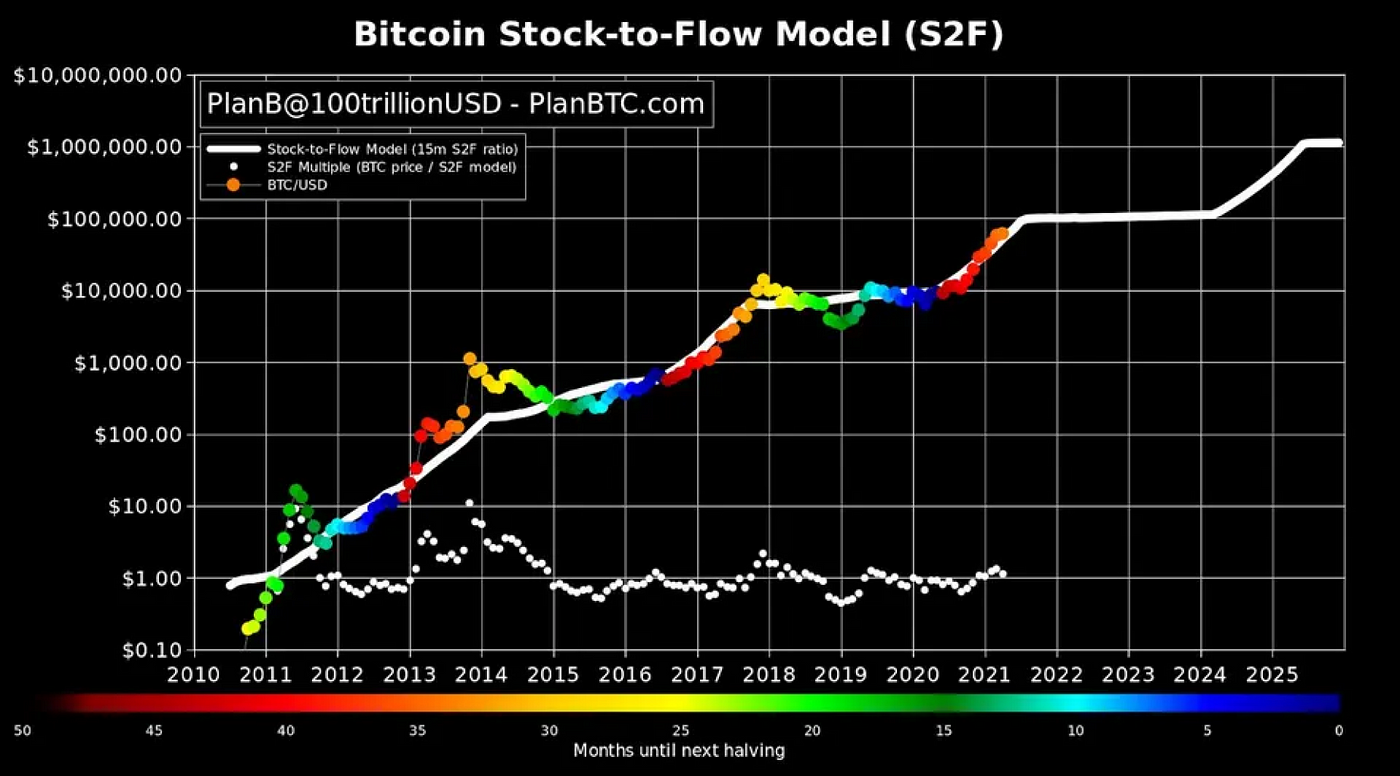

Trying to predict the future price of Bitcoin and other cryptocurrencies is a daunting task that many have tried and failed at. Amid the cacophony of predictive models, there’s one that often stands out: the Stock-to-Flow (S2F) model. Today, we delve into the intricacies of this model, which suggests that Bitcoin will skyrocket to $500,000 by 2025.

Breaking Down the Stock-to-Flow Model

The S2F model operates on a basic formula: it divides the current supply (stock) of Bitcoin by its expected production (flow) in the next year. The fundamental assumption here is that as fewer Bitcoins are mined due to the pre-established schedule of diminishing mining rewards and maximum supply, the stock-to-flow ratio will progressively increase.

This is where basic economic principles come into play. When supply outstrips demand, value drops. Conversely, when demand outstrips supply, value rises. It’s the fundamental law of supply and demand. The S2F model assumes that Bitcoin’s supply will plateau, while demand will persist or even increase, leading to an escalation in Bitcoin’s value.

However, the inherent assumption that demand will remain constant or increase is a calculated gamble. It’s near impossible to predict market dynamics with absolute certainty.

How Accurate Is the S2F Model?

Historically, the S2F model has had a decent track record, predicting BTC prices quite accurately until 2021. Yet, it fell short when BTC’s price failed to hit the model’s estimate of $106,000. In fact, Bitcoin’s price has seen higher peaks and deeper valleys than the model’s projections, leading to a noticeable deviation in 2021.

An important point to remember is that the S2F model was formulated in 2019, and its historical data fits well because the model was designed to match it. Therefore, a line graph of Bitcoin’s price (in USD) compared to the S2F ratio may seem to align perfectly, but we’re comparing apples to oranges. It’s like correlating two things simply because they share a superficial similarity.

Moreover, there are critical elements that this model doesn’t factor in. Regulatory changes, market sentiment, technological advancements, geopolitical events, and the general macroeconomic environment can greatly influence Bitcoin’s price.

Understanding Halvings and Local Highs

Halvings — events where the reward for mining Bitcoin transactions is halved to ensure Bitcoin’s scarcity — occur approximately every four years. Historically, these halvings have often led to significant price increases. But the timing between a halving and the subsequent price peak isn’t always consistent, making market timing challenging.

Here are the last three and the next projected Bitcoin halvings:

- November 2012

- July 2016

- May 2020

- April 2024

The corresponding local highs happened as follows:

- June 2011 (too close to initial Bitcoin creation)

- November 2013 (12 months after 1st halving)

- December 2018 (28 months after 2nd halving)

- November 2021 (18 months after 3rd halving)

Attempting to predict the exact impact of these halvings on Bitcoin’s price is speculative at best. However, if enough market participants believe a price increase will follow a halving, their collective actions could create a self-fulfilling prophecy.

Limitations and Challenges of the S2F Model

While the S2F model’s underlying assumption of Bitcoin’s growing adoption and scarcity is plausible, it’s impossible to predict the exact extent of this upward trend. Furthermore, the model will fail spectacularly if the USD experiences hyperinflation.

Additionally, predicting future prices with absolute precision is almost impossible — it’s akin to predicting societal sentiment or global economic conditions. Regulatory uncertainty and potential legal constraints could also significantly impact Bitcoin’s demand, hence influencing its price.

Conclusion

Predictive models like the S2F can be enticing as they provide a semblance of certainty in the chaotic world of cryptocurrency. However, we must remember that these models are based on assumptions and educated guesses. While they can give us potential trajectories, they can never provide absolute certainty.

As you navigate the crypto market, keep in mind that prices are extremely volatile and driven by a complex web of factors. Try to stay informed, vigilant, and discerning about different prediction models and their underlying assumptions. And remember, no model can guarantee 100% accuracy — always prepare for deviations.

Thank you for reading, and I hope you found this article insightful. Remember, in the world of cryptocurrency, knowledge is your most valuable asset.

P.S. The performance of the S2F model in the coming years will provide a fascinating experiment in survivor bias. If it succeeds, it’ll be hailed as a soothsayer. If it fails, it will quietly fade away or be ‘fixed’. Something to ponder on!

What is CryptoXpress?

CryptoXpress will democratise and simplify traditional financial services for a new generation. Started by a group of experienced global blockchain experts, the company provides an easy-to-use mobile app to access a range of crypto and banking digital services. A best-in-class user experience to buy/trade crypto, access NFT marketplaces, conduct payments and digital transfers, and access other exclusive loyalty, retail and member benefits.

CryptoXpress was started in 2018 by a group of global blockchain, design and finance industry experts. This application was created as a means to solve the various problems faced by consumers and their cryptocurrency. The reality of cryptocurrency is that, although the world is experiencing a constant increase in the demand to invest more in cryptocurrencies, the steep learning curve poses a restriction for beginners and first-time investors, thereby limiting the market’s true potential.

Get in touch with CryptoXpress

Links · Telegram · Twitter · Instagram · Website · LinkedIn · YouTube